But, at the same time, it involves lots of costs because of a separate setup at each location. Managerial or management accounting focuses on providing information for use by internal users, the management. This branch deals with the needs of the management rather than strict compliance with generally accepted accounting principles. Forensic accounting involves investigating financial discrepancies and providing expert witness testimony in legal proceedings.

Organizational objectives

- Its main goal is to ensure that stakeholders from all parts of the world can understand financial reporting and compare it consistently and reliably.

- The primary role of managerial accounting is to equip management with timely and pertinent financial data.

- This establishes standards to assure consistency and reliability of financial reporting.

- The accounting standard adopted by most global economies, International Financial Reporting Standards (IFRS), is also followed by international accountants.

- Accounting Tools examine how these costs affect a business and how they can be better managed.

- A qualified accountant can help explain the different types of accounting and assess your situation to determine which type of accountant would be the best fit for you.

This technological evolution has influenced the following aspects of accounting operations. Here are vital considerations that can guide the selection of the best accounting method for your organization. Financial accounting is produced according to the rules of the Income Tax Department and is consistent and comparable across companies. Failure to comply with these rules leads to legal consequences and loss of investor and other stakeholder confidence.

Branches Of Accounting

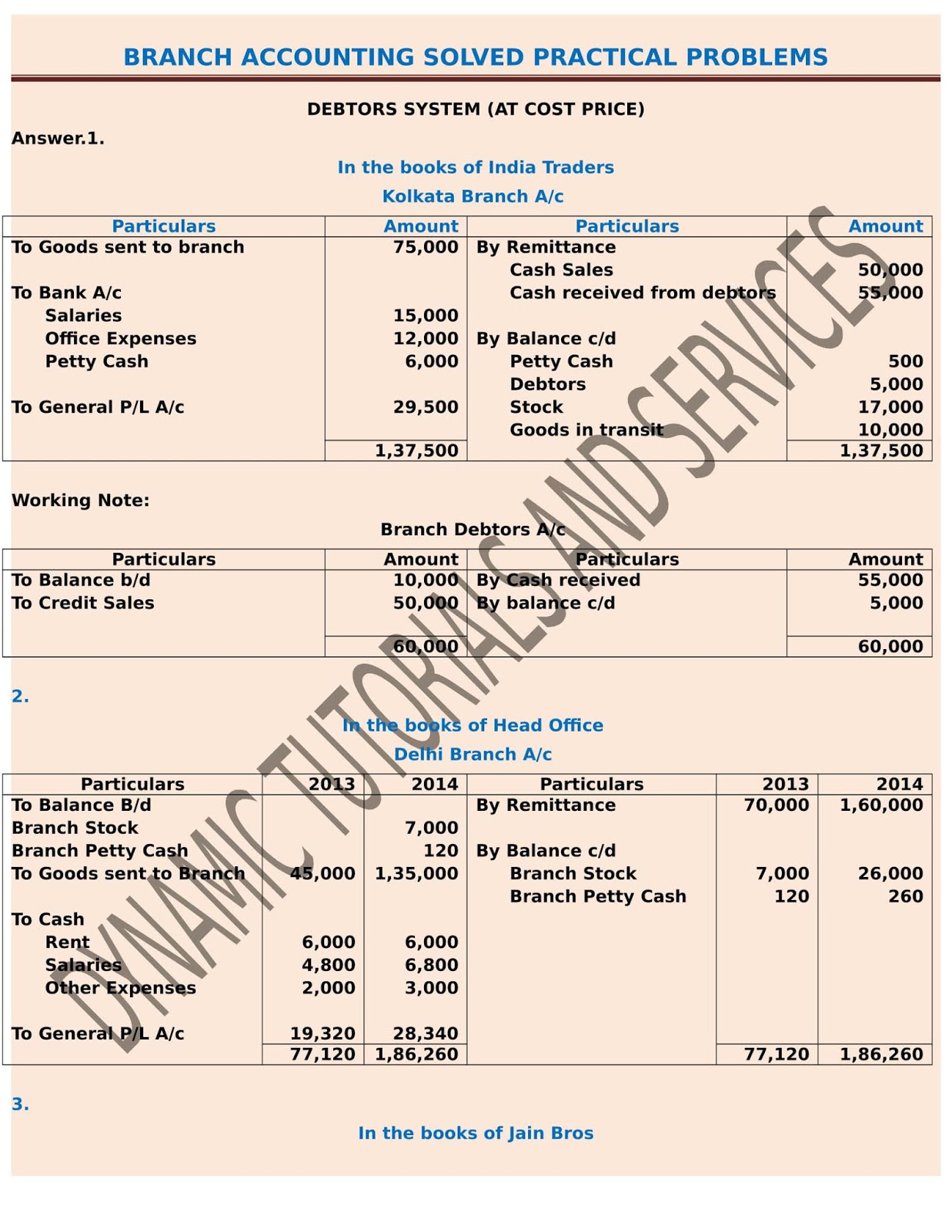

This branch manages a company’s fixed assets, such as machinery and buildings. It includes understanding depreciation schedules, maintaining accurate asset records, and providing information to help managers make decisions about capital investments. Branch Accounting is the system of bookkeeping under which the company maintains separate accounts for each of the operating locations or branches of the company. It is followed to increase transparency and know the company’s cash flow position and financial picture. Technology is transforming accounting through automation, artificial intelligence, and cloud computing.

The different branches of accounting

This is specifically related to the administration and guardianship of property. Forensic accountants need to reconstruct financial data when the records aren’t complete. This could be to decode fraudulent data or convert a cash accounting system to accrual accounting. Also known as management accounting, this type of accounting provides data about a company’s operations to managers. This branch of accounting helps in handling the state and federal fund allocation and disbursement. It is also called public accounting as it indirectly serves the general public.

Government Accounting

The branches of accounting comprise specialized sections that cater for the different financial needs of a company. This accounting is used to supply the information to the internal structure of the company, i.e., management. These accountants have the responsibility to monitor the use of money instead of its amount. The rules of GAAP are not necessary to follow in managerial accounting and are a point of focus in the needs of management. The CIMA has prepared a set of accounting principles which are called Global Management Accounting Principles (GMAP).

Branches or Types of Accounting

Government and non-profit accounting differ in their focus on accountability and compliance with specific public fund regulations. These branches emphasize fund accounting and reporting to meet the requirements of government entities and non-profit organizations. Tax accounting revolves around systematically recording, analyzing, and reporting an organization’s financial transactions for tax purposes. It involves adhering to regulations set by tax authorities, ensuring compliance, and optimizing tax strategies. These aspects help minimize the tax burden within the framework of applicable laws.

Auditors analyze documents to ensure they comply with generally accepted accounting principles (GAAP) and detect potential fraud, errors, or misstatements. Often times considered as a subset of management accounting, cost accounting refers to the recording, the standard deduction presentation, and analysis of manufacturing costs. Cost accounting is very useful in manufacturing businesses since they have the most complicated costing process. Consider an external audit of a publicly traded company’s financial statements.

International accountants would reconcile financial statements, accounting methods, and currency conversions to create consolidated financial reports. Such reports would accurately reflect the company’s financial position and enable stakeholders to assess its global performance. It is an accounting branch dealing with tax returns and tax payments and operating distinctly at business and individual levels.

Typically, shareholders in this branch choose the auditors, preventing any potential conflicts of interest and guaranteeing their objectivity. Those who love numbers and have an eye for detail may enjoy a career in accounting. Accountants are methodical, organized and display careful attention to detail. Due to the variety of accounting specialties, you can combine your love of numbers with enforcing tax regulations, working for a non-profit, or defending property or interests. Yes, Branch Accounting can be of two main types, Home and Foreign Branches. Home branches are further categorized into dependent and independent branches, wherein the head office manages the dependent branches.

This is the practice of recording and reporting financial transactions and cash flows. This type of accounting is particularly needed to generate financial reports for the sake of external individuals and government agencies. These financial statements report the performance and financial health of a business.